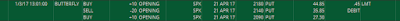

Last week I opened one broken wing butterfly (BWB) on the SPX (April 28 expiration) and adjusted six of my existing put butterflies:

|

| (click to enlarge) |

Due to meetings at work I was late in making two of my six adjustments. These late adjustments were made on Feb 17. The corresponding entries and adjustment descriptions are listed below in the order the adjustments were made.

Trade Entry: Jan 3 - deep out of the money (DOTM) BWB on the Apr 21 exp (see image or

post)

Adjustment: Feb 13 - moved 4 of the 10 2180 puts to the 2170 strike for a $0.80 credit

Note: SPX up 101 points from entry (2249.75); DIT 47

|

| (click to enlarge) |

Trade Entry: Jan 6 - DOTM BWB on the Mar 10 expiration (see image or

post)

Adjustment: Feb 13 - moved 1 of the 2 2210 puts to the 2200 strike for a $0.30 credit

Note: SPX up 72 points from entry (2279.07); DIT 44

|

| (click to enlarge) |

Trade Entry: Feb 2 - BWB on the Apr 7 expiration (see image or

post)

Adjustment: Feb 13 - moved all 3 of the 2310 puts to 2300 for a $3.05 credit

Note: SPX up 72 points from entry (2278.99); DIT 17

|

| (click to enlarge) |

Trade Entry: Jan 24 - BWB on the Mar 31 expiration (see image or

post)

Adjustment: Feb 13 - moved all 3 of the 2300 puts to 2285 for a $3.70 credit

Note: SPX up 77 points from entry (2274.32); DIT 26

|

| (click to enlarge) |

Trade Entry: Jan 26 - BWB on the Mar 24 expiration (see image or

post)

Adjustment: Feb 17 - moved all 3 of the 2325 puts to 2310 for a $3.80 credit

Note: SPX up 55 points from entry (2296.65); DIT 24

|

| (click to enlarge) |

Trade Entry: Feb 9 - BWB on the Apr 13 expiration (see image or

post)

Adjustment: Feb 17 - moved all 3 of the 2325 puts to 2315 fro a $2.90 credit

Note: SPX up 48 points from entry (2303.16); DIT 10

|

| (click to enlarge) |

Some of these adjusted trades will most likely be losing trades. With so many winning trades this year, I was starting to get uncomfortable...my core BWB has historically had a 75% win rate and I felt I was long overdue for some losers.

I currently have nine open trades, with expirations in March, April, and May. Total defined risk for these trades has increased with this week's adjustments and is currently at 59.9% of the account net liquidation value. This risk is broken down into the following groups:

- 15.8% of net liq - DOTM BWB

- 44.1% of net liq - core BWB at 75% of target size

Nine trades have been closed this year...eight wins and one loss. Return on the account for the year is at 2.8%. With nearly 60% of my account net liq being used, I will most likely not add any trades next week.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".