|

| (click to enlarge) |

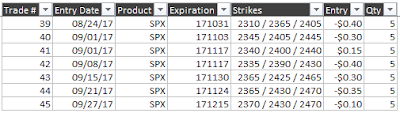

October 31 Weekly Expiration Trade (#39) - Closed 25-October (+2.1%)

- 24-August Entry (post)

- 08-September Adjustment (post)

- 12-September Adjustment (post)

- 15-September Adjustment (post)

- 27-September Adjustment (post)

November 3 Weekly Expiration Trade (#40) - Closed 25-October (+3.1%)

- 01-September Entry (post)

- 12-September Adjustment (post)

- 15-September Adjustment (post)

- 20-September Adjustment (post)

- 27-September Adjustment (post)

- 29-September Adjustment (post)

December 15 Monthly Expiration Trade (#45) - Adjusted 27-Oct

- 27-September Entry (post)

- 29-September Adjustment (post)

- 02-October Adjustment (post)

- 05-October Adjustment (post)

- 17-October Adjustment (post)

December 29 Weekly Expiration Trade (#46) - Adjusted 27-Oct

December 29 Weekly Expiration Trade (#47) - Adjusted 27-Oct

- 24-October Entry

- 26-October Adjustment

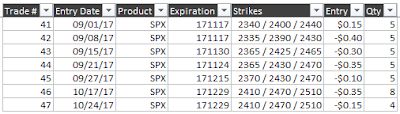

I currently have 7 open trades, with expirations in Nov (4) and Dec (3):

|

| (click to enlarge) |

Total defined risk for these trades is at 62.4% of the account net liquidation value.

40 trades have been closed this year, with 24 wins and 16 losses. Return on the account/portfolio for the year is at 4.4%. Total win rate is at 60% including hedges. The win rate on the core trades is at 67%. Still not happy with the win rate, but at least it is improving and the losses have been small.

Of the 7 open trades, 5 currently have a positive P&L. The trades with negative P&L were entered during the last ten days:

|

| (click to enlarge) |

Next week I will be looking for new trades in the weekly January expirations (if available). I will make adjustments in my existing trades as follows:

- Highly Likely: N/A

- Likely: #46, #47

- Possible: #44

- Unlikely: #41, #42, #43, #45

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".