2017 is now in the history books and it's time to review my trading performance.

2017 was a scaling up year for me, using smaller sized trades and tuning my trading processes for traveling extensively on planes. My typical week had me in the air about 10 hours every Monday and 10 hours every Thursday. This year is looking like more of the same, with only the destination changing.

During 2017 I traded two hedge strategies and three butterfly strategies. In the table below, I've calculated the win % by strategy, the profits and losses as a percentage of portfolio starting value, and profit factors.

|

| (click to enlarge) |

The RTT Put Butterfly is the standout winner, with a win rate of 81% and a profit factor of 14. The hedges did not generate any profits and were a drag on returns...but they helped me sleep a bit better.

Total portfolio returns for the year were a tiny +5.4%, with all winning trades contributing +10% of the returns, and all losing trades contributing -4.6% of the returns. Total win rate for all trades came in at 63%.

The table below breaks down the win % by strategy over each quarter of 2017. Not much to see here, but the distribution is sort of interesting.

|

| (click to enlarge) |

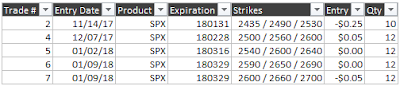

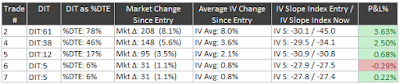

I collected quite a bit of data on my trades last year, including implied volatility on each strike on entry and exit. I analyzed all of the data to see if there was any correlation between

returns and conditions at entry, exit, and the difference between entry and exit. I ran this correlation analysis on each of the three core strategies I traded. Here's what I found:

- Days In Trade - negative correlation; my trades with shorter duration had higher returns

- Market Change - negative correlation; my trades had higher returns when the SPX moved the least

- Change In Strike IV - negative correlation; my trades where the IV of each of the strikes dropped, or changed very little, had higher returns

- IV slope of the 3 put strikes at entry:

- 60-40-20 - negative correlation; my trades with steeper put IV slope had higher returns

- RTT - slight positive correlation; my trades with steeper put IV slope had lower returns

- IV slope of the 3 put strikes at exit:

- 60-40-20 - no correlation

- RTT - positive correlation; my trades with steeper put IV slope had lower returns

- Change between entry and exit in the IV slope of the 3 put strikes:

- 60-40-20 - positive correlation; trades with the smallest change in put IV slope had the higher returns

- RTT - positive correlation; trades with the smallest change in put IV slope had the higher returns

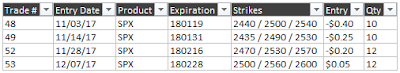

So you might be wondering if any of these correlations can help you at trade entry. Based on my analysis of the metrics above, and others, I'd say no. Put skew, put slope, market indicators, etc. did not have any ability to predict whether a trade would be profitable in my live trading. Here are a couple of charts displaying my actual return distribution versus two indicators at trade entry for the RTT trade.

|

| (click to enlarge) |

|

| (click to enlarge) |

Based on this data, I am going to stop monitoring strike IV, put slope, and put skew for these trades. My analysis indicates that these metrics are more likely to be noise than useful. Incidentally, I came to this same conclusion in my 600K+ backtest trades for Iron Condors ... which can be found

here.

For 2018, I will be watching fewer indicators at trade initiation, since the correlation between indicator values and P&L seem to be nonexistent or very weak at best. In 2018, I will continue to trade the RTT, but in larger size. I will also add some DN Iron Condor trades on the weeklies (~63 DTE time frame). I am considering adding small size strangles and/or straddles to the mix as well.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".