| (click to enlarge) |

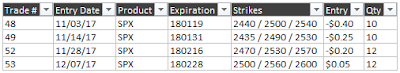

Trade #53: February 28 Weekly Expiration BWB - Adjusted 19-Dec & 22-Dec

- 07-December Entry (post)

- 08-December Adjustment (post)

- 19-December Adjustment

- 22-December Adjustment

I currently have 4 open trades, with expirations in Jan (2) and Feb (2). Total defined risk for these trades is at 68% of the account net liquidation value.

|

| (click to enlarge) |

Of the 4 open trades, all 4 currently have positive P&L:

(click to enlarge)

|

49 trades have been closed this year, with 31 wins and 18 losses. Return on the account/portfolio for the year is at 5.4%. Total win rate is at 63% including hedges. The win rate on the core trades is at 72%, and getting closer to the historical win rate. Still not happy with the core trade win rate, but at least it is improving and the losses have been small.

I will be on vacation in Mexico all next week, and will try to keep from making any adjustments. Any adjustments to my existing trades will follow the priorities outlined below:

- Highly Likely: N/A

- Likely: N/A

- Possible: #52, #53

- Unlikely: #48, #49

If I was in town next week, I'd start looking at the 16-March monthly expiration trade. So unfortunately / fortunately an entry for that expiration will probably have to wait for the first week of January.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".