|

| (click to enlarge) |

Original Trade Entry: March 9 - BWB on the May 12 expiration (see this post)

Closed: April 24 - profit

| (click to enlarge) |

Original Trade Entry: April 21 - BWB on the Jun 23 expiration (post)

Adjustment: April 25 - added a second BWB on the Jun 23 expiration

| (click to enlarge) |

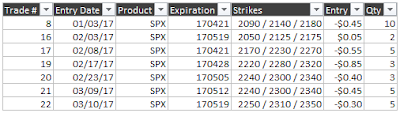

I currently have 5 open trades, with expirations in May (1), June (3), and July (1):

|

| (click to enlarge) |

Total defined risk for these trades is still at 36.8% of the account net liquidation value. This risk is broken down into the following groups:

- 7.8% of net liq - DOTM BWB - hedges

- 29% of net liq - core BWB

I have run 10, 10 year backtests on my deep out of the money broken wing butterfly hedges. While they can work as a decent hedge if timed properly, over time they appear to lose money using my trading approach. I will phase out this style of hedge in the next few weeks.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".