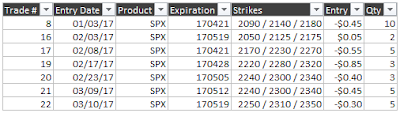

I currently have 7 open trades, with expirations in April (3) and May (4):

|

| (click to enlarge) |

Total defined risk for these trades is currently at 39.9% of the account net liquidation value. This risk is broken down into the following groups:

- 12.3% of net liq - DOTM BWB - hedges

- 27.7% of net liq - core BWB (at 75% of target size, but increasing with new trades)

15 trades have been closed this year...9 wins and 6 losses. Return on the account for the year is at 1.5%. Total win rate is at 60%. Win rate on core trades is at 62% and on the low side of the expected range. Of the 7 open trades, 5 are core and 4 of the core are currently up money.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.