| (click to enlarge) |

- Original Trade Entry: April 18 - BWB on the June 30 expiration (post)

| (click to enlarge) |

- Adjustment: May 18 - moved some upper longs on the June 30 expiration (post)

| (click to enlarge) |

|

| (click to enlarge) |

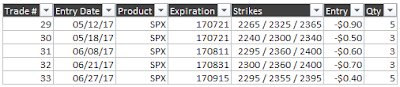

Total defined risk for these trades had dropped to 28.5% of the account net liquidation value.

28 trades have been closed this year...16 wins and 12 losses. Return on the account for the year is at 2.9%...not happy with that number! Total win rate is at 57%. The win rate on the core trades is at 67% and creeping up. Not happy with the core trade win rate. Of the 5 open trades, 4 currently have a positive P&L.

Broken wing butterflies are really struggling lately and not performing as well as last year. I am digging into the iron condor backtest results a bit more right now to see how well they have performed in 2017.

I will be out of the country over the next two weeks, and don't anticipate making any trades or adjustments...but we'll see!

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.