|

| (click to enlarge) |

October 20 Monthly Expiration Trade - Adjusted 12-Sep & 15-Sep

October 20 Weekly Expiration Trade - Adjusted 12-Sep & 15-Sep

October 20 Weekly Expiration Trade - Adjusted 12-Sep & 15-Sep

October 31 Weekly Expiration Trade - Adjusted 12-Sep & 15-Sep

November 3 Weekly Expiration Trade - Adjusted 12-Sep & 15-Sep

- 01-September Entry (post)

November 17 Monthly Expiration Trade - Adjusted 15-Sep

- 08-September Entry (post)

November 17 Weekly Expiration Trade - Adjusted 15-Sep

- 01-September Entry (post)

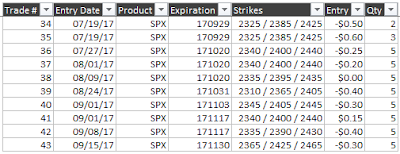

I currently have 10 open trades, with expirations in Sep (2), Oct (4), and Nov (4):

|

| (click to enlarge) |

Total defined risk for these trades 68.5% of the account net liquidation value.

33 trades have been closed this year...17 wins and 16 losses. Return on the account for the year is at 2.8%. Total win rate is at 52%. The win rate on the core trades is at 59%. Not happy with the win rates, but at least the losses have been small. Of the 10 open trades, 8 currently have a positive P&L. The 2 trades that have a negative P&L were entered this week (1 trade on 15-Sep) and last week (1 trade on Sep-8). This week's trade is down -0.15% on margin, and last week's trade is down 0.46% on margin...these numbers are typical in the first week or so of the trade.

Next week I will close trades #34 and #35 as they have little profit remaining and closing them will free up some margin. Besides entering one new trade next week, I will make adjustments as follows:

- Highly likely: #36, #37

- Likely: #40

- Possible: #39, #41, #42

- Unlikely: #38, #43

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.