This week was quite a challenge. There were big market moves and I was away from my trading platform for three of the five days this week. On Monday and Thursday I happened to be on planes without WIFI nearly all day on both days. Friday I was at a sports arena without WIFI and poor cell phone reception. So Friday morning with three of my trades at max loss, I closed them out ... putting my portfolio P&L for the year at -8.1% ... not great, but also not bad considering the market movement.

Here's a picture of the SPX movement during the week, with the periods I was not able to trade highlighted in yellow ... pretty bad luck, but survivable! I made

late upside adjustments (removing hedges) during a layover between flights on Monday. On Thursday, I landed just in time to see the market close, but too late to make any adjustments.

|

| (click to enlarge) |

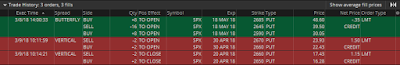

Details of this week's trading is shown below:

|

| (click to enlarge) |

Trade #4: February 28 Weekly Expiration BWB - 28-Feb Expired for a loss (-4.5%)

- 07-December Entry (post)

- 08-December Adjustment (post)

- 19-December Adjustment (post)

- 22-December Adjustment (post)

- 02-January Adjustment (post)

- 05-January Adjustment (post)

- 05-February Hedge (post)

- 06-February Hedge (post)

- 08-February Hedge (post)

- 09-February Hedge (post)

- 14-February Hedge Exit (post)

- 15-February Hedge Exit (post)

- 26-February Hedge Exit

Trade #5: March 16 Monthly Expiration BWB - Closed 02-Mar (-11.9%)

- 02-January Entry (post)

- 02-January Adjustment (post)

- 05-January Adjustment (post)

- 11-January Adjustment (post)

- 22-January Adjustment (post)

- 02-February Adjustments (post)

- 05-February Hedge (post)

- 06-February Hedge (post)

- 08-February Hedge (post)

- 09-February Hedge (post)

- 14-February Hedge Exit (post)

- 15-February Hedge Exit (post)

- 21-February Hedge Exit (post)

- 26-February Hedge Exit

Trade #6: March 29 Weekly Expiration BWB - Closed 02-Mar (-17.3%)

- 09-January Entry (post)

- 11-January Adjustment (post)

- 22-January Adjustment (post)

- 30-January Adjustment (post)

- 02-February Adjustments (post)

- 05-February Hedge (post)

- 06-February Hedge (post)

- 08-February Hedge (post)

- 09-February Hedge (post)

- 14-February Hedge Exit (post)

- 21-February Hedge Exit (post)

- 26-February Hedge Exit

Trade #7: March 29 Weekly Expiration BWB - Closed 02-Mar (-8.7%)

- 09-January Entry (post)

- 11-January Adjustment (post)

- 22-January Adjustment (post)

- 30-January Adjustment (post)

- 02-February Adjustments (post)

- 05-February Hedge (post)

- 06-February Hedge (post)

- 08-February Hedge (post)

- 09-February Hedge (post)

- 14-February Hedge Exit (post)

- 15-February Hedge Exit (post)

- 21-February Hedge Exit (post)

- 26-February Hedge Exit

Trade #8: April 20 Monthly Expiration BWB - Adjusted 02-Mar

- 21-February Entry (post)

- 02-March Hedge

|

| (click to enlarge) |

Trade #9: April 30 Weekly Expiration BWB - Adjusted 02-Mar

- 21-February Entry (post)

- 02-March Hedge

|

| (click to enlarge) |

I currently have 2 open trades, with expirations in Apr (2). Total defined risk for these trades is at 18.4% of the account net liquidation value.

|

| (click to enlarge) |

My two new trades are currently underwater with negative P&L. The P&L% numbers in the table below are based on the maximum risk associated with each trade.

|

| (click to enlarge) |

7 trades have been closed this year, with 3 wins and 4 losses. The total win rate is at 43%. Realized return on the account/portfolio for the year is -8.1%. Trade results are summarized below:

|

| (click to enlarge) |

For next week, I will be watching the SPX action to determine if I add more hedges or remove the current hedges. I will also be looking to add a May expiration trade. I will make adjustments to my existing trades as follows:

- Highly Likely: N/A

- Likely: N/A

- Possible: #8, #9

- Unlikely: N/A

Before I end this post, I want to do a bit of a post-mortem on my losing March expiration trades. In all of the risk graphs below, the vertical red line is where I closed these trades on March 2nd, and the low of the day. The horizontal red arrows point to yellow vertical lines where the SPX closed on March 2nd.

My 16-Mar expiration trade looked similar to the risk graph below when I closed the trade. IV was a bit higher at that time though, so the purple t+0 line was closer to where the red vertical line crosses the thick horizontal yellow bar.

|

| (click to enlarge) |

Before I closed this 16-Mar trade, I did model adding debit spread hedges, but they didn't seem to help the risk graph much when the IV was as high as it was.

|

| (click to enlarge) |

You can see where I would have ended the day had I not closed this trade (-$1,398 / -4%), or if I had added the debit spreads (-$2,518 / -7%) the morning of March 2nd.

Here are a similar set of risk graphs for my two 29-Mar expiration trades. I have combined both trades in the following set of risk graphs. The first risk graph shows what the positions looked like when I exited the trades. Although, at the time I exited, the IV was higher than the end-of-day IV.

|

| (click to enlarge) |

If I had added the debit spread hedges, rather than exiting, my risk graph would have looked like the one below. When I compared these two graphs on the morning of March 2nd (with higher IV!), they didn't look very different. This lead me to close both of these 29-Mar trades.

|

| (click to enlarge) |

Hindsight being 20/20, leaving these trades alone, without closing or adjusting, would have been the best move. At the time though, it seemed like the SPX was going to continue its drop. Hard to say if I would make a different decision if I was in the same situation again.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".