|

| (click to enlarge) |

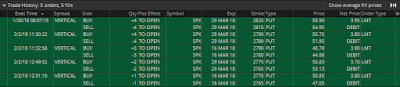

Details of this week's trading is shown below:

|

| (click to enlarge) |

Trade #5: March 16 Monthly Expiration BWB - Adjusted 02-Feb

- 02-January Entry (post)

- 02-January Adjustment (post)

- 05-January Adjustment (post)

- 11-January Adjustment (post)

- 22-January Adjustment (post)

- 02-February Adjustments

Trade #6: March 29 Weekly Expiration BWB - Adjusted 30-Jan, 02-Feb

- 09-January Entry (post)

- 11-January Adjustment (post)

- 22-January Adjustment (post)

- 30-January Adjustment

- 02-February Adjustments

Trade #7: March 29 Weekly Expiration BWB - Adjusted 30-Jan, 02-Feb

- 09-January Entry (post)

- 11-January Adjustment (post)

- 22-January Adjustment (post)

- 30-January Adjustment

- 02-February Adjustments

I currently have 4 open trades, with expirations in Feb (1) and Mar (3). Total defined risk for these trades is at 78% of the account net liquidation value.

|

| (click to enlarge) |

Of the 4 open trades, only one currently has positive P&L:

|

| (click to enlarge) |

3 trades have been closed this year, with 3 wins and 0 losses. Return on the account/portfolio for the year is at 1.07%. Total win rate is at 100% including hedges. The win rate on the core trades is also at 100%.

I was going to add the 20-April expiration trade this week, but the pricing was a little too favorable, so I elected to wait until next week ... glad I did! Next week, I will again look to add a 20-April expiration trade. I will make adjustments to my existing trades as follows:

- Highly Likely: N/A

- Likely: N/A

- Possible: #4, #5, #6, #7

- Unlikely: N/A

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.