|

| (click to enlarge) |

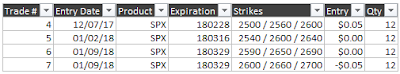

Trade #4: February 28 Weekly Expiration BWB - No adjustments this week

- 07-December Entry (post)

- 08-December Adjustment (post)

- 19-December Adjustment (post)

- 22-December Adjustment (post)

- 02-January Adjustment (post)

- 05-January Adjustment (post)

- 05-February Hedge (post)

- 06-February Hedge (post)

- 08-February Hedge (post)

- 09-February Hedge (post)

- 14-February Hedge Exit (post)

- 15-February Hedge Exit (post)

|

| (click to enlarge) |

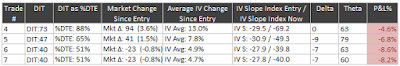

Trade #5: March 16 Monthly Expiration BWB - Adjusted 21-Feb

- 02-January Entry (post)

- 02-January Adjustment (post)

- 05-January Adjustment (post)

- 11-January Adjustment (post)

- 22-January Adjustment (post)

- 02-February Adjustments (post)

- 05-February Hedge (post)

- 06-February Hedge (post)

- 08-February Hedge (post)

- 09-February Hedge (post)

- 14-February Hedge Exit (post)

- 15-February Hedge Exit (post)

|

| (click to enlarge) |

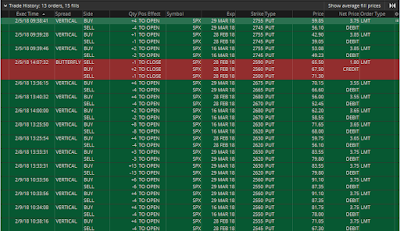

Trade #6: March 29 Weekly Expiration BWB - Adjusted 21-Feb

- 09-January Entry (post)

- 11-January Adjustment (post)

- 22-January Adjustment (post)

- 30-January Adjustment (post)

- 02-February Adjustments (post)

- 05-February Hedge (post)

- 06-February Hedge (post)

- 08-February Hedge (post)

- 09-February Hedge (post)

- 14-February Hedge Exit (post)

|

| (click to enlarge) |

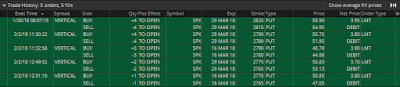

Trade #7: March 29 Weekly Expiration BWB - Adjusted 21-Feb

- 09-January Entry (post)

- 11-January Adjustment (post)

- 22-January Adjustment (post)

- 30-January Adjustment (post)

- 02-February Adjustments (post)

- 05-February Hedge (post)

- 06-February Hedge (post)

- 08-February Hedge (post)

- 09-February Hedge (post)

- 14-February Hedge Exit (post)

- 15-February Hedge Exit (post)

|

| (click to enlarge) |

Trade #8: April 20 Monthly Expiration BWB - Entry 21-Feb

- 21-February Entry

|

| (click to enlarge) |

Trade #9: April 30 Weekly Expiration BWB - Entry 21-Feb

- 21-February Entry

|

| (click to enlarge) |

I currently have 6 open trades, with expirations in Feb (1), Mar (3), Apr (2). Total defined risk for these trades is at 97% of the account net liquidation value. Removing hedges last week increased the risk in the account.

|

| (click to enlarge) |

4 of the 6 trades are currently underwater with negative P&L. All of the P&L% numbers in the table below are based on the maximum risk associated with each trade.

|

| (click to enlarge) |

If I were to close all four trades at this time, my account would be down 3.6% for the year ... not terrible considering the market action during the first part of February.

3 trades have been closed this year, with 3 wins and 0 losses. Realized return on the account/portfolio for the year is at 1.07%. Total win rate is at 100% including hedges. The win rate on the core trades is also at 100%. These numbers will very likely change as I close out my open trades.

If the SPX continues much above 2750, I will need to start closing out my Feb and March expiration trades for losses. The Feb trade will be expiring this week and will be a loss. I will be keeping an eye on the SPX this week. I will make adjustments to my existing trades as follows:

- Highly Likely: N/A

- Likely: N/A

- Possible: #4, #5, #6, #7, #8, #9

- Unlikely: N/A

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".